23 October 2025 The Hindu Editorial

What to Read in The Hindu Editorial( Topic and Syllabus wise)

Editorial 1: Tapping the shine

Context

India needs to emerge as a supplier of solar power to ensure the sustainability of its domestic industry.

Introduction

India’s solar power journey reflects one of the most significant shifts in its energy landscape. From being a coal-dominated economy, India has emerged as the world’s third-largest solar producer. With falling costs, policy support, and domestic manufacturing growth, solar energy now anchors India’s transition toward sustainable development and climate-resilient power generation.

India’s Solar Power Progress and Challenges

Growth of Domestic Solar Industry

- India has successfully developed a domestic solar power ecosystem.

- Around 2017, the cost of solar power fell below coal power, encouraging private investment in large solar projects.

- As per the International Renewable Energy Agency (IREA, 2024-25), India produced 1,08,494 GWhof solar energy —

➤ 3rd largest producer globally after China and the S., surpassing Japan.

- As per the International Renewable Energy Agency (IREA, 2024-25), India produced 1,08,494 GWhof solar energy —

- Solar module manufacturing capacityrose from 2 GW (2014) → 100 GW (2025) (MNRE data).

- Effective production capacity, however, stands at ≈85 GW, despite higher installed capacity (≈117 GW as of Sept 2025).

Climate Commitments and Capacity Targets

- India aims to source 50% of its total powerfrom non-fossil fuels by 2030 (~500 GW).

- Solar power target:250–280 GW.

- To achieve this, India must add ~30 GW annually, but current addition is only 17–23 GW per year.

Production Cost and Global Competition

- Indian modules are 5–2 × costlierthan Chinese modules.

- Causes: smaller scale, costlier raw materials, weaker supply chains.

- Exports (2024):

- India → U.S.: 4 GW(benefiting from U.S. import restrictions on China).

- China → World: 236 GW.

- Implication: India’s upcoming large capacities may face market saturationunless it finds new buyers abroad.

Strategic Expansion and Africa Opportunity

- India seeks to become a “solar supplier” to Africaunder the International Solar Alliance (ISA)

- PM-KUSUM(rural solar pumps) and PM-Surya Ghar (urban rooftop solar) schemes are slow domestically but can be replicated in Africa,

where only 4% of arable land is irrigated due to power scarcity. - China remains the dominant solar supplierin Africa; India must position itself as a credible second option to ensure its industry’s sustainability.

Summary Table

| Aspect | Key Data / Observation | Implication |

| Global Rank | 3rd (after China, U.S.) | Major renewable power player |

| Solar Generation (2024-25) | 1,08,494 GWh | Surpassed Japan |

| Manufacturing Capacity | 2 GW (2014) → 100 GW (2025) | Rapid expansion |

| Effective Capacity | ~85 GW | Gap between installed & real output |

| Annual Addition Needed | 30 GW till 2030 | Current rate 17–23 GW |

| Cost Factor | 1.5–2 × costlier than China | Competitive disadvantage |

| Exports (2024) | India – 4 GW vs China – 236 GW | Limited export reach |

| Key Schemes | PM-KUSUM, PM-Surya Ghar | Models for Africa |

| ISA Role | Solar diplomacy with Africa | Expands market, boosts industry |

Conclusion

India’s solar industry stands at a pivotal juncture — rich in potential yet constrained by costs and global competitiveness. To sustain momentum, India must enhance production efficiency, secure export markets, and expand solar diplomacy through the International Solar Alliance (ISA). Aligning innovation, affordability, and market diversification will ensure solar energy drives both national sustainability and global climate leadership.

Editorial 2: The tailwinds from lower global oil prices

Context

However, the respite for India may prove temporary, as the oil market’s cyclical nature often reverses gains swiftly.

Introduction

Among current global developments shaping India’s interests, attention often turns to the conflicts in Gaza or Ukraine or the U.S. tariff wars. Yet, a far more consequential contest is emerging as the battle for control of the global oil market. This struggle between OPEC+ and other oil producers, with consumers gaining greater influence, will critically determine how much India, the world’s third-largest oil importer, stands to benefit.

Global Importance of Crude Oil

- Crude oilremains the world’s most valuable commodity, forming the backbone of modern industrial and transport systems.

- Over 100 million barrels per day (mbpd)are produced globally, with nearly half of this volume traded across international markets.

- At current prices, the daily value of global crude tradeexceeds $3 billion, underscoring its vast economic scale.

- Beyond being a key energy and petrochemical input, crude oil also serves as a critical financial asset, influencing global liquidity, trade balances, and capital flows.

Global Oil Market: Technology and Demand Shifts

- Over the last two decades, technological advancesand economic changes have had a bearish impact on the global oil market.

- Technological Drivers

- Shale oil extraction, horizontal drilling, and deep-sea explorationhave expanded production capacity.

- These breakthroughs increased supply from non-traditional regions, contributing to persistent oversupplyand downward price pressure.

- Demand-Side Transformation

- Global demand growthis nearing its peak, with strong divergence between regions:

- Developing economies (Global South):Moderate growth from a low consumption base.

- Developed economies:Stagnant fossil fuel demand due to weak post-COVID recovery, climate policies, and rise of EVs.

- In 2025, oil demand is projected to grow by 3 million barrels per day (1.2%), with only 10%of that growth from OECD countries (which account for 46% of global GDP).

- China, the world’s largest oil importer, faces slower consumptionas EVs reach 50% of new vehicle sales and economic growth moderates.

- Surge in Supply

- Global production rose by 6 mbpdcompared to last year:

- OPEC+contributed 1 mbpd as it reversed COVID-era cuts.

- Additional supply came from the S., Canada, Brazil, Guyana, and Argentina.

- This rise has created a clear supply overhangin the market.

- Price Movements and Market Adjustments

- Brent crudestands at $61 per barrel, marking a 16% fall since the start of the year.

- Nearly half of this fall occurred in the past month, showing a sharp recent decline.

- The fall was partly cushioned as:

- Consumers refilled strategic reservesat lower prices.

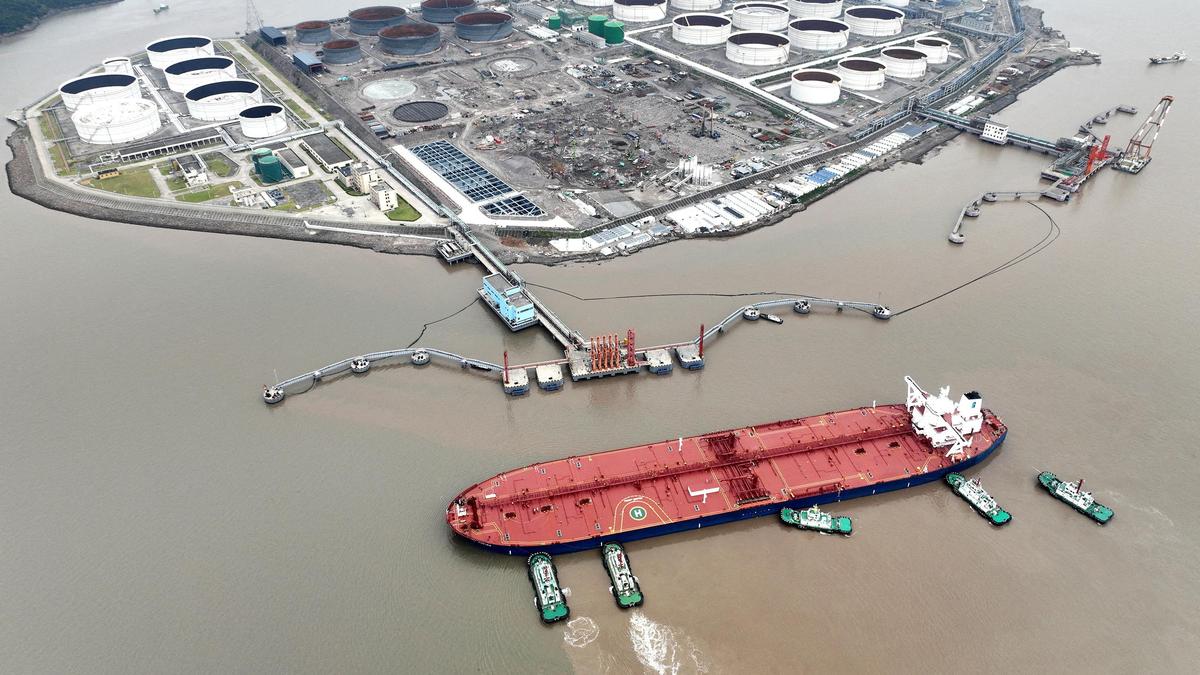

- Producers stored over 100 million barrelson floating tankers to avoid flooding the market.

Global Oil Market Trends and Outlook

- Despite major geopolitical disruptionssuch as the China–U.S. tariff war and Ukrainian drone attacks on Russian hydrocarbon facilities, oil prices have continued to decline.

- The emerging supply gluthas created tensions within the OPEC+ alliance:

- Saudi Arabia, the leading exporter, wants to end production cuts earlyto regain market share and recover lost revenues.

- Russia, under strict export sanctions, advocates a slower, more cautious approachto avoid further losses.

- A sharp disagreementexists between OPEC and the International Energy Agency (IEA) over future supply-demand trends:

- OPECforecasts a shortfall of 50,000 barrels per day (bpd) by 2026.

- IEApredicts an oversupply of nearly 4 million bpd (mbpd), indicating a possible price collapse.

- Most global think-tankssupport the IEA’s assessment, expecting an oversupplied market and Brent crude prices dropping to the low $50s per barrel, a 10–20% decline from current levels.

- The volatile oil marketremains vulnerable to geopolitical shifts, including:

- The lifting of sanctionson Russia, Iran, and Venezuela,

- Renewed West Asian tensions, or

- Trade de-escalationbetween major economies.

- The IMF’s World Economic Outlook (Oct 2025)describes the global economy as “in flux”, warning of dim growth prospects:

- Global GDP growthis projected to slow to 2% in 2025 and 3.1% in 2026.

- World trade growthexpected to fall to 9% (2025–26) from 3.5% (2024).

- These macroeconomic and geopolitical trendscollectively indicate a downside risk to global oil prices in the coming years.

Impact of Falling Oil Prices and U.S. Dollar on India

- Overall Economic Impact

- The simultaneous fall in oil pricesand the S. dollar is expected to have a net positive effect on India’s economy.

- In 2024–25, India’s oil import billstood at $137 billion.

- Every $1 decline in oil priceimproves India’s current account deficit (CAD) by $1.6 billion.

- Fiscal and Inflationary Effects

- Lower oil pricesreduce both the subsidy burden and inflationary pressures.

- The government retains much of the savings, leading to an improved fiscal balance.

- Enhanced fiscal space allows higher capital expenditure (CapEx), giving a boost to growth.

- Geopolitical and Trade Implications

- The oil glutcould lower India’s dependence on discounted Russian crude, thereby reducing the tariff frictions with the United States.

- However, a slowdown in West Asian economiesmay weaken remittances, exports, and investments.

- Caution and Policy Outlook

- The global oil marketremains highly cyclical — current relief may be temporary.

- India should continue to pursue energy efficiency, diversification, and consumption-mitigation strategiesto ensure long-term stability.

Conclusion

While lower global oil prices offer India short-term fiscal and inflationary relief, the advantage is inherently fragile. The cyclical nature of oil markets, combined with slowing global growth and geopolitical volatility, may quickly reverse current gains. Sustained resilience will depend on India’s commitment to energy diversification, efficiency reforms, and strategic investments in renewable capacity.

![]()